| Profit maximization is the most accurate description of managerial goal. The profit maximization is one of the very important assumptions of economic theory, which always assumes that a firm aims to maximize profit. The attempt of an entrepreneur to maximize profit is regarded as a rational behavior. Hence, profit maximization continues to be a central concept in managerial economics. |

There are two approaches to explain the equilibrium of a firm on the context of profit maximization. Among them one is old method of total cost and total revenue approach and another is the marginal revenue and marginal cost approach.

Total Revenue (TR) – Total Cost (TC) Approach

i) Equilibrium of the firm under perfect competition

The firm is in equilibrium when it has no incentive to change its level of output. In perfect competition, a firm is said to be in equilibrium when it maximizes its profits (π), which is defined as the difference between total revenue and total cost.

π = TR – TC

Where,

π = profit,

TR = Total Revenue and

TC = Total Cost

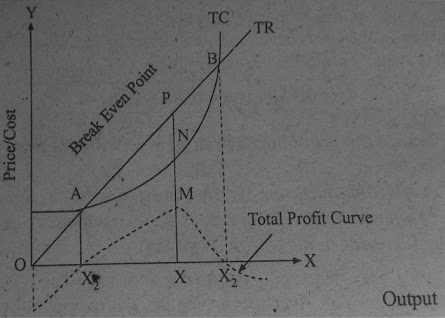

As shown in the figure, TR and TC are total revenue and total cost curves of a firm in a perfectly competitive market. TR curve in a straight line through the origin, showing that the price is constant at all levels of output. The firm is a price taker and can sell any amount of output at the going market price, with its TR increasing proportionately with its sales. The slope of TR curve is the MR. It is constant and equal to the prevailing market price. Since all units are sold at the same price.

The slope of TC curves reflects ‘U’ shape of the AC curve i.e. law of variable proportions. The firm maximizes its profit at the output ‘OX’, where the distance between TR and TC is the greatest. At the lower (OX1) and higher levels (OX2) than OX, the firm has losses. The TR-TC approach awkward to use when firms are combined together in the study of the industry.

ii) Equilibrium of the Firm under Imperfect Competition (Monopoly)

The slope of TC curves reflects ‘U’ shape of the AC curve i.e. law of variable proportions. The firm maximizes its profit at the output ‘OX’, where the distance between TR and TC is the greatest. At the lower (OX1) and higher levels (OX2) than OX, the firm has losses. The TR-TC approach awkward to use when firms are combined together in the study of the industry.

ii) Equilibrium of the Firm under Imperfect Competition (Monopoly)

Under imperfect competition, AR and MR of a firm are two different things. This is because under imperfect competition, a firm is a price-maker. It can sell more by lowering the price of its output. In the figure, AR and MR curves of a firm fall downward from left to right. According to this approach, for a firm to be equilibrium or maximization of profit, marginal revenue should be equal to marginal cost and the marginal cost curve should cut the marginal revenue curve from below.

Marginal Revenue (MR) - Marginal Cost (MC) Approach

Marginal revenue and marginal cost approach is another method to know the equilibrium of a firm. The modern economist Mrs. John Robinson propounded this approach. According to this approach, for a firm to be equilibrium or maximization of profit, marginal revenue (MR) should be equal to marginal cost (MC) and the marginal cost curve should - cut the marginal revenue curve from below. It will be profitable for a firm to increase its production when MR exceeds MC.

i) Equilibrium of the firm under perfect competition

The equilibrium of a firm in the perfect competition can also be shown through the help of marginal revenue (MR) and marginal cost (MC) approach. For fulfilling the condition of maximum profit, marginal cost (MC) must be less than marginal revenue (MR). A firm is said to be in equilibrium when marginal cost (MC) must be equal to the marginal revenue (MR) or MC curve must intersect MR curve from below. It is shown in the figure:

ii) Equilibrium of a firm under imperfect competition (Monopoly)

Under imperfect competition, AR and MR of a firm are two different things. This is because under imperfect competition, a firm is a price-maker. It can sell more by lowering the price of its output. In the figure, AR and MR curves of a firm fall downward from left to right. According to this approach, for a firm to be equilibrium or maximization of profit, marginal revenue should be equal to marginal cost and marginal cost curve should cut the marginal revenue curve from below.

In this figure, at point E both the conditions of equilibrium have been fulfilled. Hence, E is the point of equilibrium. The firm gets equilibrium at OM output where marginal revenue is equal to marginal cost. The OM quality of output is sold at price OP price. Before OM output, the increase in output add more to revenue than to cost but after OM output, the increase in output adds more to cost than revenue. Profit is the total revenue OMQP minus total cost OMNR. Hence, the firm earns the abnormal profit equal to RNQP.

Criticisms/ Demerits of Profit Maximization Theory

Criticisms/ Demerits of Profit Maximization Theory

The objective has been criticized by some economists saying there may have other objectives in a firm such as sales maximization, welfare or satisfactions etc. This objective is criticized on the following grounds.

- Profit maximization criterion is vague and ambiguous. Profit may be long-term, after tax or before tax. It is not clear.

- In this objective, total profit earned during the life of assets and timing of their realization is ignored. Hence, equal value for earning realized on different periods is not realistic. It ignores the time value of money.

- This objective is concerned only with the size of profit and gives no weight to the degree of uncertainty of future profits. Two businesses with varying degree of risk and producing same size of profit is considered similar under profit maximization criterion. Thus, the risk element is ignored, which is one of the most important dimensions of financial management.

- This objective is incomplete because it ignores the appreciation in the value of securities or firm. Investors and owners of the businessmen are benefited not only by the earning of profit, but also due to the appreciation in the stock price.

No comments:

Post a Comment